Magnesium Sulfate Heptahydrate HS Code Structure:

Global Harmonized System (HS) Code: 2833210000

Category: Inorganic chemicals; compounds of magnesium

Description: Covers all forms of magnesium sulfate, including anhydrous, monohydrate, and heptahydrate variants.

Every product crossing international borders requires precise classification to ensure smooth trade operations. The magnesium sulfate heptahydrate HS code, 28332100, serves as a globally recognized identifier that facilitates customs clearance and regulatory compliance. HS codes, developed by the World Customs Organization, act as standardized descriptors for goods, enabling efficient communication among countries and industries. Accurate classification not only prevents delays but also ensures adherence to trade regulations, safeguarding businesses against penalties.

Key Takeaways

The HS code 28332100 is for magnesium sulfate heptahydrate. It helps with customs and following rules.

Using the correct Magnesium Sulfate Heptahydrate HS Codes avoids delays and fines in trade.

Asking trade experts and using trusted tools can lower mistakes.

Training workers on Magnesium Sulfate Heptahydrate HS Codess reduces errors and improves trade.

Always check Magnesium Sulfate Heptahydrate HS Codes with customs to meet local rules.

What is the HS Code?

Definition and purpose of HS codes

HS codes, short for Harmonized System codes, are standardized numerical identifiers used globally to classify goods in international trade. Developed by the World Customs Organization, these codes streamline communication between countries and industries. Customs authorities rely on HS codes to identify, evaluate, and sort products efficiently, expediting clearance processes. They also play a pivotal role in determining import duties and ensuring compliance with trade regulations. By providing a universal classification system, HS codes simplify global commerce and reduce misunderstandings in trade documentation.

Tip: Accurate HS code usage prevents delays and penalties, safeguarding businesses during international transactions.

How HS Codes Are Structured

The structure of HS codes follows a systematic format that ensures consistency across borders. Each code typically consists of six digits, divided into three components:

Component | Description |

|---|---|

First Two Digits | Indicate the category or description of the product. |

Next Two Digits | Indicate the heading of the product. |

Last Two Digits | Provide a more detailed description of the product. |

Some countries extend the standard six-digit code to meet specific needs. For instance:

The United States uses a ten-digit code known as Schedule B or HTS code.

The European Union may add extra digits for detailed customs information.

Understanding this structure enables businesses to classify goods accurately, ensuring correct duty calculations and smooth customs clearance.

Why HS Codes Are Essential for Trade Compliance

HS codes provide a standardized framework for classifying goods, which is vital for maintaining consistent trade compliance. Misclassification can result in severe consequences, including delays, increased costs, and penalties from customs authorities. Accurate classification ensures proper tariff application, directly impacting the financial aspects of trade. By adhering to HS code regulations, businesses avoid disruptions and enhance their credibility in international markets.

Note: Proper HS code usage not only facilitates compliance but also strengthens trade relationships by fostering transparency and trust.

Magnesium Sulfate Heptahydrate HS Code

Specific Magnesium Sulfate Heptahydrate HS Codes

The specific Magnesium Sulfate Heptahydrate HS Codes is 28332100. This code falls under the category of "sulfates" within the broader classification of inorganic chemicals. The first two digits, 28, represent inorganic chemicals, while the subsequent digits narrow down the classification to sulfates and then to magnesium sulfate heptahydrate. This precise categorization ensures that customs authorities can easily identify the product during international trade.

Businesses dealing with magnesium sulfate heptahydrate must use this Magnesium Sulfate Heptahydrate HS Codes in their trade documentation. Accurate usage of the code facilitates smooth customs clearance and ensures compliance with global trade regulations. Misusing or omitting the correct HS code can lead to delays, penalties, or even the rejection of shipments.

Note: Always verify the Magnesium Sulfate Heptahydrate HS Codes with local customs authorities, as some countries may add additional digits for further classification.

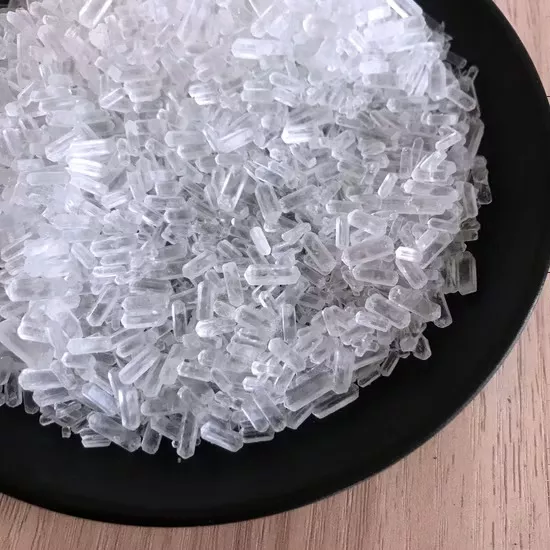

Classification Criteria for Magnesium Sulfate Heptahydrate

Magnesium sulfate heptahydrate is classified based on its chemical composition and physical properties. The product contains magnesium, sulfur, and oxygen, with seven molecules of water of crystallization. These characteristics place it under the sulfate category in the Magnesium Sulfate Heptahydrate HS Codes.

Key criteria for classification include:

Chemical Composition: The presence of magnesium and sulfate ions.

Hydration Level: The heptahydrate form, which contains seven water molecules.

Physical Form: Typically available as crystals or granules.

Customs authorities may also consider the product's intended use, such as agricultural, industrial, or pharmaceutical applications, when verifying its classification. For example, magnesium sulfate heptahydrate used as a fertilizer might require additional documentation to confirm its purpose.

Variations or Related Codes to Consider

While 28332100 is the specific Magnesium Sulfate Heptahydrate HS Codes related products may fall under slightly different codes. Variations in hydration levels or chemical composition can influence the classification. For instance:

Magnesium Sulfate Anhydrous: This form, lacking water molecules, may have a different HS code.

Magnesium Sulfate Monohydrate: With only one water molecule, this product is classified separately.

Kieserite (Magnesium Sulfate Monohydrate for Fertilizer): Often used in agriculture, it may require additional classification details.

Businesses should carefully review the product specifications and consult trade experts to ensure the correct Magnesium Sulfate Heptahydrate HS Codes is applied. Using the wrong code can result in incorrect tariff calculations or customs delays.

Tip: Utilize online HS code lookup tools or consult with customs brokers to identify related codes for magnesium sulfate products.

Common Misconceptions About Magnesium Sulfate Heptahydrate HS Codes

Misclassification Risks

Misclassification of HS codes is a frequent issue in international trade, often stemming from a misunderstanding of their legal significance. Many importers mistakenly believe that HS code classification is flexible and can be adjusted to reduce tariffs. However, this is not the case. The classification of products under Harmonized Tariff Schedule (HTS) codes is a legal obligation, not a marketing strategy. Importers bear full responsibility for ensuring accurate classification, even when relying on advice from suppliers or customs brokers. Failure to comply with these legal requirements can result in audits, penalties, and supply chain disruptions.

Alert: Customs authorities impose fines based on the severity and frequency of misclassification errors, making accuracy essential for avoiding financial and operational setbacks.

Differences Between HS Codes and Tariff Codes

A common misconception is that HS codes and tariff codes are interchangeable. While they share similarities, they serve distinct purposes. HS codes are standardized six-digit identifiers used globally to classify goods. Tariff codes, on the other hand, are country-specific extensions of HS codes that provide additional details for determining duties and taxes. For example, the United States uses a ten-digit Harmonized Tariff Schedule (HTS) code, while the European Union may add extra digits for its own requirements.

Aspect | HS Codes | Tariff Codes |

|---|---|---|

Scope | Global | Country-specific |

Length | Six digits | Varies (e.g., 8-10 digits) |

Purpose | Classification of goods | Duty and tax determination |

Understanding this distinction is crucial for businesses to ensure compliance with both international and local trade regulations.

How to Verify the Correct HS Code

Verifying the correct HS code requires a systematic approach. Businesses should start by analyzing the product's composition, function, and intended use. Consulting official tariff schedules and using online HS code lookup tools can provide initial guidance. However, relying solely on these resources may not suffice for complex products. Regular training and collaboration with trade compliance experts can significantly reduce the risk of errors.

Key Steps for Verification:

Review the product's technical specifications.

Cross-check with official customs documentation.

Seek advice from customs brokers or legal consultants.

Errors in classification can lead to financial losses, including overpayment or underpayment of duties. Customs authorities may also subject businesses to audits and increased scrutiny, further complicating trade operations. Proactive measures, such as regular staff training and expert consultations, help mitigate these risks and ensure compliance.

Tip: Always confirm Magnesium Sulfate Heptahydrate HS Codes with local customs authorities to account for country-specific variations and avoid costly mistakes.

Practical Tips for Using HS Codes

How to Find HS Codes for Other Products

Finding the correct HS code for a product requires a systematic approach. Businesses should begin by analyzing the product's composition, function, and intended use. Official resources like the Harmonized System (HS) Codes database provide a global classification system for identifying products in international trade. For U.S. exports, the Schedule B system, managed by the U.S. Census Bureau, offers detailed classifications. Similarly, the Harmonized Tariff System (HTS), administered by the USITC, is essential for U.S. imports.

Resource | Description |

|---|---|

Harmonized System (HS) Codes | A global product classification system used for identifying products. |

US Schedule B | A classification system for U.S. exports, managed by the U.S. Census Bureau. |

Harmonized Tariff System (HTS) | A classification system for U.S. imports, managed by the USITC. |

Businesses can also use online tools and databases to simplify the search process. Platforms like ImportGenius provide access to verified trade data, shipment records, and HS codes. These tools allow users to track shipments, analyze competitors, and verify suppliers, ensuring accurate classification.

Tools and Resources for HS Code Lookup

Several tools and resources are available to assist businesses in identifying accurate Magnesium Sulfate Heptahydrate HS Codes. Online databases, such as the World Customs Organization's HS Code Finder, offer a user-friendly interface for searching codes by product description. Government websites, including customs portals, often provide free access to tariff schedules and classification guides.

Best Practice | Benefit |

|---|---|

Ensures accurate classification, preventing miscalculations in costs. | |

Streamlined Customs Clearance | Reduces delays or rejections at borders, ensuring efficient trade. |

Cost Efficiency | Prevents overpayment or underpayment of tariffs, saving money. |

Risk Mitigation | Reduces disputes or legal issues from incorrect classifications. |

Using these tools, businesses can validate their classifications and avoid costly errors. Regular updates to these resources ensure compliance with changing trade regulations.

Importance of Consulting Trade Experts

Navigating the complexities of HS codes can be challenging, especially for businesses new to international trade. Collaborating with customs brokers and trade consultants provides access to specialized knowledge and experience. These experts help classify products accurately, optimize tariff treatments, and ensure compliance with regulations.

Importance | Action | Benefits |

|---|---|---|

Complex HS Code System | Work with customs brokers and consultants. | Accurate classification, optimized tariffs, and compliance with regulations. |

Documentation Preparation | Seek expert assistance. | Streamlined export processes and reduced errors. |

Failing to consult experts can lead to excessive or insufficient duty payments, confiscation of goods, or border delays. Businesses may also face fines, penalties, or denial of import privileges. Expert guidance minimizes these risks, ensuring smooth trade operations and financial efficiency.

Tip: Consulting trade experts not only ensures compliance but also helps businesses maximize the benefits of Free Trade Agreements and avoid additional charges like demurrage fees.

The magnesium sulfate heptahydrate HS code, 28332100, plays a vital role in ensuring smooth international trade operations. Accurate classification prevents delays, reduces penalties, and ensures compliance with global trade regulations. Businesses must prioritize precision when assigning HS codes to their products. Utilizing reliable resources, such as official customs databases, and consulting trade experts can significantly reduce errors. These steps not only streamline customs clearance but also enhance a company’s reputation in the global market.

Reminder: Always verify HS codes with local customs authorities to account for country-specific requirements.

FAQ

What is the purpose of the HS code 28332100?

The HS code 28332100 identifies magnesium sulfate heptahydrate in international trade. It ensures accurate classification, smooth customs clearance, and compliance with global trade regulations. This code helps customs authorities determine the correct duties and taxes for the product.

Can the Magnesium Sulfate Heptahydrate HS Codes vary by country?

The base HS code (28332100) remains consistent globally. However, some countries extend it with additional digits for specific tariff or regulatory purposes. Businesses should verify local requirements with customs authorities to ensure compliance.

How can businesses avoid Magnesium Sulfate Heptahydrate HS Codes misclassification?

Businesses should analyze product specifications, consult official tariff schedules, and use reliable Magnesium Sulfate Heptahydrate HS Codes lookup tools. Collaborating with customs brokers or trade experts ensures accurate classification, reducing the risk of penalties or shipment delays.

Tip: Regular staff training on HS code usage can further minimize errors.

Are there tools available to verify HS codes?

Yes, several tools assist with HS code verification. These include the World Customs Organization's HS Code Finder, government customs portals, and trade databases like ImportGenius. These resources simplify the classification process and ensure accuracy.

Why is magnesium sulfate heptahydrate classified under sulfates?

Magnesium sulfate heptahydrate contains magnesium, sulfur, and oxygen, with seven water molecules. These chemical properties place it under the "sulfates" category in the Magnesium Sulfate Heptahydrate HS Codes system. Its classification reflects its composition and hydration level.

Note: Customs authorities may also consider its intended use during classification.